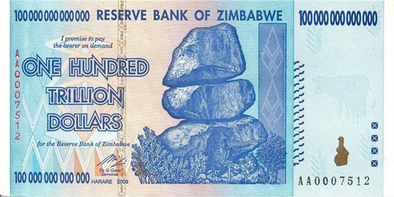

Gideon Gono, the governor of the Reserve Bank of Zimbabwe who destroyed the Zim dollar by creating hyperinflation, weighs in on the parallels between QE3 and the policy he followed last decade, in the RBZ’s mid-term 2012 monetary policy statement. Gonowrites (my emphasis in bold):

2.14 Within this context, the Government of Zimbabwe failed to meet fiscal obligations from budgetary allocations which were severely eroded by rising inflation. As such, the financing of recurrent and capital expenditures presented serious challenges to Government.

2.15 These negative developments threatened to bring the country’s social service delivery system and the economy at large to a complete halt, thereby further impoverishing the Zimbabwean people.

2.16 It is against this background that Government stepped in to save the situation through various interventions by the Reserve Bank of Zimbabwe.

2.17 These interventions which were exactly in the mould of bail out packages and quantitative easing measures currently instituted in the US and the EU, were geared at evoking a positive supply response and arrest further economic decline.

But even still,

2.20 Despite numerous intervention measures undertaken by Government through the Reserve Bank of Zimbabwe, economic activity continued to decline progressively with inflation peaking at 231 million percent by July 2008. Other challenges that affected the economy include the following:

- Frequent power outages;

- Cash shortages;

- Acute foreign currency shortages;

- Skills flight;

- Vibrant parallel market for goods and foreign exchange;

- Erratic fuel supplies;

- Endemic speculative and rent seeking behaviour; and

- Rapid rise in production costs.

Even though Ben Bernanke and Mario Draghi and all other central bankers will try to convince you that what they are doing are really different to what Gideon Gono did, you should really be taking Gideon Gono more seriously, who is basically admitting that the money printing strategy does not work to ‘stimulate’ growth. All it can stimulate are high- and hyperinflation risks.

RSS Feed

RSS Feed