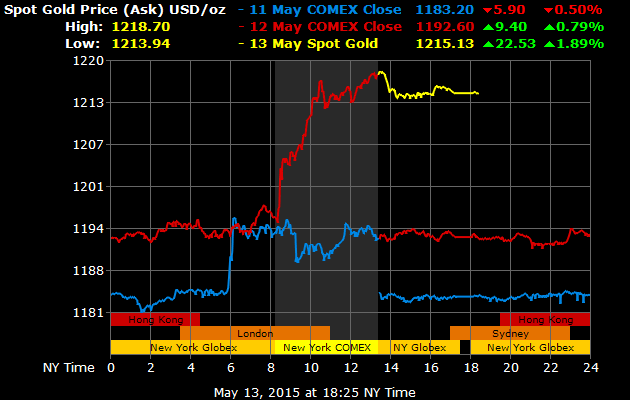

Gold rose US$22/oz almost 2% from yesterday's close, with the weak sales data reducing the chance of a near term hike in US cash rates by the Federal Reserve. This put downward presseure on the US$, which was inversely reflected in the gold pirce.

|

Gold rose to its highest level in US$ in over 5 weeks on the back of disappointing US retail sales data. Seems the collapse of the high wage shale oil industry and the increased pace of offshoring white collar jobs has meant those left employed don't get paid much. Who would have thought that would affect retail sales?

Gold rose US$22/oz almost 2% from yesterday's close, with the weak sales data reducing the chance of a near term hike in US cash rates by the Federal Reserve. This put downward presseure on the US$, which was inversely reflected in the gold pirce.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Follow our CEO on Twitter

Favourite videos

Archives

August 2016

|

RSS Feed

RSS Feed