|

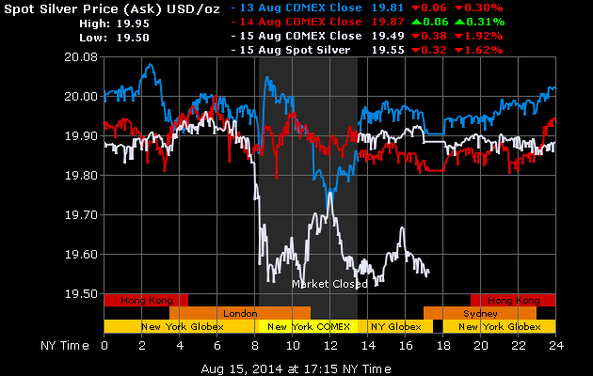

Well that was a great start to the new LBMA Silver Price (see here for details of new London Silver Price), from the moment the London Silver Price was announced (at 12:02 London time) the Silver Market tanked by over 2% in the following hour, hardly an accurate pricing mechanism.

Press Release from LBMA.org.uk

Friday, August 15, 2014 CME Group, LBMA and Thomson Reuters launches the first LBMA Silver Price today. The London Silver Fix has been a global benchmark for 117 years and the new price will provide pricing and liquidity continuity for market participants. The new electronic auction process increases transparency and the potential number of direct market participants. The LBMA Silver Price provides a fully IOSCO-compliant solution to the London bullion market and streamlines the dissemination of data to numerous data vendors. Our intention throughout the market consultation and implementation process has been to minimise any possible disruptions and facilitate a seamless transition for the market. This has been achieved today through the partnership with the CME Group and Thomson Reuters. CME Group provides the electronic auction platform on which the price is determined and Thomson Reuters, as the LBMA Silver Price benchmark administrator, is responsible for administration and governance. The LBMA will accredit price participants and own the intellectual property rights. The benchmark price will continue to be published and distributed by various data vendors and will be available on the LBMA’s website. The market has met the challenges imposed by not only the short time-frame but also by the practical implementation of the new auction platform and governance procedures. Given the strong market engagement in the live testing and accreditation process, the LBMA fully expects the list of price participants will grow over the coming weeks as more participants meet the formal requirements to participate in the LBMA Silver Price. These participants include banks, trading houses, refiners and producers. Although the accreditation process has been undertaken quickly and efficiently, the tight schedule and time of year has imposed constraints on some potential participants meeting the 15th August deadline. Price participants were required to secure internal sign-off on the necessary credit, legal, compliance and IT requirements. This means that it was not possible to accredit by the 15th August all those who participated in the live trials and who are at various stages of satisfying the requirements for accreditation. The LBMA will continue to publish LBMA Silver Price Participants on its website as they are accredited. Further information about LBMA Silver Price including a set of FAQs is available on the LBMA’s website. Ruth Crowell, Chief Executive of the LBMA commented “I am delighted that the first LBMA Silver Price will be launched today. This is the culmination of an intense three month period of consultation, discussions and preparation. I would like to take the opportunity to thank all those who have been involved in the process. The LBMA has been overwhelmed with the support that it has received from its partners, CME Group and Thomson Reuters as well as LBMA members and other participants in the wider market. Without the engagement and support of the market we would not have been able to implement the solution. I would also like to extend my thanks to those who have already achieved accreditation as a price participant and to those who are progressing towards accreditation. Last and not least, I would like to thank both CME Group and Thomson Reuters who have pulled out all the stops to ensure that the LBMA Silver Price was launched on schedule. To have satisfied all of the legal, compliance, regulatory and IT requirements in such a short window is testament to their dedication and support for the London Bullion Market.” For further information please contact Aelred Connelly, PR Officer, on Tel: +44 (0)20 7796 3067 or AG.Consult@lbma.org.uk. About the London Bullion Market Association The LBMA is the international trade association that represents the wholesale over-the-counter market for gold and silver bullion. The LBMA undertakes many activities on behalf of its members and the wider market, including the setting of good delivery and refining standards, the organisation of conferences and other events, and serving as a point of contact for the regulatory authorities. For more information, please visit www.lbma.org.uk From RT Published on Aug 14, 2014 In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the Portrait of Uncle Sam aging horribly in the basement of Fort Knox and on the real economic data charts while flouncing around the world as if a spritely and handsome young thing. In the second half, Max interviews Nick Lambert and David Irvine of MaidSafe about reinventing the internet with proof of resource and decentralization. Executive Summary:

In line with our expectations,1 Q2 gold demand of 963.8 tonnes (t) was considerably weaker year-on-year – 16% below Q2 2013’s 1,148.3t. Sharp declines in the consumer segments of gold demand came as no surprise, given the stark contrast in conditions in the global gold market between the two time periods. Jewellery demand was almost a third lower, while bar and coin investment was less than half Q2 2013 levels. Gold ETFs saw modest outflows of 39.9t, which were far smaller than the 402.2t of outflows seen during the year-earlier period. The net impact on overall investment was a modest 4% year-on-year increase. Access report here From ClarkeAndDawe From Peter Schiff From Goldbrokercom  Hi all, we just read something that made me fully understand what a Tola is and as a result why the digits 375 are often a reference point in the precious metal industry. From The Hindu Business Online http://www.thehindubusinessline.com/opinion/the-original-big-bulls-of-bullion/article6305102.ece At the centre of it all was the rupee, which, since 1835, had been a silver coin containing one tola (0.375 troy ounces) of the metal of 91.67 per cent fineness. Besides being a token coin made of silver, it was freely convertible against the pound sterling at a fixed exchange rate of one shilling and four pence (1s 4d; one pound=20s and 1s=12d). As India had the world’s largest economy from at least the year 1000AD into the late 17th century, Indian financial measurements were in used across the Indian sphere of influence, which spread over all of SE Asia via religion and trade. When the French introduced the metric system across their colonies in the early1800's - Vietnam, Laos, Cambodia and part of South China the 375 number was converted into grams. With 37.5 grams being referred to as a Mot Luong or simply a Luong, then from there decimal factions of a Luong such one tenth being 3.75g. From wikipedia: In French Indochina, the colonial administration standardised the tael (lạng) as 100 g, which is commonly used at food markets where many items typically weigh in the 100–900 g range. However, a different tael (called cây, lạng, or lượng) unit of 37.5 g is used for domestic transactions in gold. Real estate prices are often quoted in taels of gold rather than the local currency over concerns over monetary inflation. |

Follow our CEO on Twitter

Favourite videos

Archives

August 2016

|

RSS Feed

RSS Feed